What is life insurance?

Life insurance is about making sure your dependents would have the money they need if you were no longer around. Life insurance provides a lump sum if you die or become terminally ill with less than 12 months to live.

You might also decide that you want peace of mind and the reassurance that you and your family would have a financial cushion were you to get a serious illness, such as cancer. If you choose Zurich Life Insurance and Critical Illness cover, you would receive your chosen cover amount upon being diagnosed with any one of 39 conditions. You would also be covered for two additional payment conditions (less advanced cancer of the breast, less advanced cancer of the prostate) which pay up to £25,000.

You can find out more about the differences between life-only, and life insurance with critical illness policies below.

Get up to £100 of vouchers

Use promo code ZOFFERS100 during the quick quote.

T&Cs apply - voucher issued after 6th payment received. Voucher value depends on premium paid, maximum £100. Promotion FAQs

Amazon restrictions apply see www.amazon.co.uk/gc-legal

How does life insurance work?

Want to know more about the different types of life insurance, and what each policy offers?

Zurich Life Insurance explained

Simply choose whether you want life insurance only, or life and critical illness cover, when you get a life insurance quote. You will have various options, including creating a single policy or a joint policy covering you and a partner. You can also choose if you want your payments to stay the same or increase over time to give you better protection against increases in the cost of living. Both life-only and life with critical illness policies provide access to Zurich Support Services, including counselling and mental health support.

If you’re not sure what type of life cover is best for you, read our life insurance guide or speak to an independent financial adviser.

If you’re not sure how much cover you’ll need, try our Zurich Life Insurance calculator.

Life Insurance or Life Insurance with Critical Illness cover

Life Insurance

- Provides a lump sum if you die or become terminally ill with less than 12 months to live

- Cover your mortgage, or other financial commitments you don’t want to leave behind for someone else to deal with

- Cover living expenses and other things your loved ones may need help with

- Flexible cover to suit you and your family’s circumstances

- Optional cover available for broken bones, dislocations and ligament damage

Life Insurance and Critical Illness cover

- Provides a lump sum if you die, become terminally ill or suffer a critical illness that your policy covers (click Zurich Life Protection Key Features pdf below to see a list of conditions covered)

- Helps absorb the financial impact of serious illness such as cancer, heart attack or stroke

- You can only take out critical illness with a life insurance policy

- You can choose how much cover you would like, and for how long

- You can also add cover for your children

Zurich Life Insurance features and benefits

Cover for your children

Add children’s benefit and we’ll pay up to £25,000 if your child is diagnosed with one of the same 41 conditions you are covered for. Available on a life and critical illness policy only.

Multi-fracture cover

Add multi-fracture cover and we will pay a lump sum of up to £6,000 if you break a bone, dislocate a joint, rupture your Achilles tendon or tear a knee ligament. Available on both a life insurance and a life and critical illness policy.

Change your policy

If something changes in your life, like buying a bigger home or having a baby, you may be able to increase your cover without giving us any more details about your health or activities. Bear in mind that increased cover will result in increased payments.

Separation benefit

If you have a joint policy and you separate or divorce, you can cancel this policy and start individual policies for one or both of you, without needing to provide any more medical information.

Zurich Life Insurance calculator

Not sure how much cover you’ll need? Enter a few details about your circumstances and we’ll give you an idea of a suitable level of cover.

Zurich Life Insurance is 5-star rated

Zurich Life Insurance has a 5-star rating under the Defaqto rating system. Defaqto is an independent comparison service for financial products.

Tools and guides

How much life insurance do you need?

While most of us will have a good understanding of when we might need life insurance, working out how much cover to choose can be tricky.

Life insurance guide

Ever wondered when to get cover? Or how to bring up the topic with your family? Talking about death is never easy, but it’s important to ensure your loved ones would be looked after financially if you were no longer around.

Types of life insurance

Term life insurance means you have cover for a specified amount of time. It’s important to consider what type of term life insurance is best for your needs. For example, you might want to choose a type of cover that would ensure any payout isn’t negatively affected by inflation, or you might only want cover for a specific reason, like paying off a mortgage.

Below, we explain the differences between level cover, increasing cover and decreasing cover.

Each of these types of term life insurance allows you to choose single or joint cover (covering you and a partner) - read our guide to single or joint life insurance.

If you’re still not sure what’s best for you, you can find more details in our Zurich Life Protection policy summary.

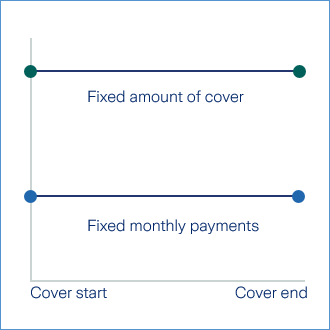

Level cover

Level life insurance – also known as level term life insurance – means your cover and payments stay the same during your policy (unless you change them).

Who is it suitable for?

Level cover is good for financially protecting you and your family, an interest-only mortgage, or a loan. You can choose single or joint cover (covering you and a partner). You may be able to increase your cover at certain milestones, such as moving house or having a child, without having to answer any medical questions. Bear in mind an increase in cover will mean an increase in payment. We’ll also consider other requests to increase cover. You can reduce your cover at any time, or the length of time you’re covered for.

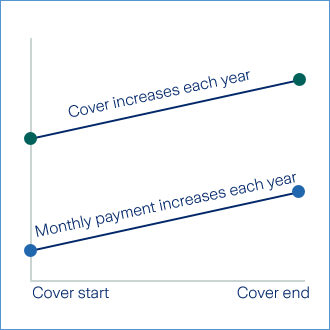

Increasing cover

Also known as increasing term cover, an increasing cover life insurance policy allows you to choose how much you want your cover to increase by each year.

Who is it suitable for?

Increasing cover is good for protecting against the rising cost of living. You can choose single or joint cover (covering you and a partner).

We set your increasing rate at the start of your policy. You can ask us to increase your cover by 3%, 5% or in line with Retail Prices Index (max 10%).

We apply the increase once every year on the anniversary of the policy start date. Your payment goes up 1.5% for every 1% increase in cover (because the risk increases as you get older).

If you have multi-fracture cover included, the cost of this will stay the same.

You can change to level cover at any time.

Decreasing cover

With a decreasing cover life insurance policy, the amount of cover decreases each month, reaching zero at the end of your term.

Who is it suitable for?

Decreasing cover is good for protecting a repayment mortgage (or other similar debt), hence why decreasing term cover is also sometimes known as mortgage life insurance.

Payments are calculated at the start and stay the same. We'll set the percentage rate at which your cover reduces. This will be explained on your quote.

Applying for a quote

When you apply for a quote with Zurich, you can specify how long you want your cover to last, and whether you want your payments to stay the same, decrease over time, or increase to keep pace with inflation.

Trees for the Future

We’re proud to be a partner of Trees for the future, helping to fund their planting and restoration projects with farmers in Africa. Over two years from January 2024, Zurich’s funding will enable the planting of more than a million trees across Mali and Senegal in West Africa.

The projects which we support help to train farmers to adopt more sustainable and regenerative practices, empower women, restore degraded land, and support the local families who depend on it. Find out more about our partnership with Trees for the Future.