What is financial risk?

Financial risk can take many forms. In essence, it’s the likelihood of losing money or not achieving expected returns because of market performance, bad decisions, or unforeseen events affecting businesses and investments.

How does risk impact investors?

People invest to help them achieve their financial goals. However, investing has risk because the future is uncertain. Here are some examples of the risks that you may face as an investor:

- The value of your investments, or the income they generate, could fall, or grow more slowly than you expect.

- The value of your investments may not grow as fast as inflation does, meaning the amount your money can buy reduces over time.

- You could run out of money in retirement if the income, growth and capital value of your investments is not sufficient sustain your spending.

The risks of investments

Investments such as equities (shares) and bonds have risk, because their value and the income they generate can be affected by a wide variety of possible future events. These events include actual or expected changes in economic growth, interest rates, or inflation, as well as wars, pandemics, and political and economic uncertainty.

Asset prices move up and down as investors react to actual or anticipated events; this is known as volatility. The greater and more regular the movements, the greater the volatility, which is usually associated with greater risk.

Different types of investment have different levels of volatility, for example:

- UK Government bonds (Gilts) have relatively low volatility. The government is expected to continue to make the interest payments and to pay back the debt when the bonds mature. This means there’s a higher degree of certainty about future investment returns. Gilt prices are affected by factors such as changes in interest rates, market sentiment and inflation. The longer the time to maturity, the more the prices are affected by these factors. Their impact can be significant, which was seen in the autumn of 2022 when the Mini-Budget caused investors to lose confidence in the government.

- Equities have a relatively high volatility. Future events can affect the size and actual payment of the cash flows generated by companies many years into the future, and they are not guaranteed. As such, there’s far greater uncertainty about those future cash flows and the value of companies can fluctuate widely.

What does risk look like over time?

We can’t reliably predict how the value of an investment may change in the future. This depends on unknown future events and how investors react to them. There are an unlimited number of possible paths an investment could take.

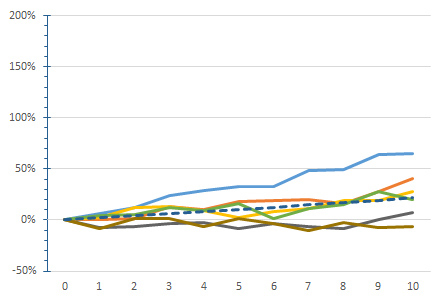

The chart below illustrates some of the possible paths an investment could take. The paths don’t represent the actual returns of any particular investment; they are just intended to illustrate the effect of volatility.

Selection of possible future paths of an investment with an assumed level of volatility and expected return

The illustration assumes the investment has a fixed level of volatility. The investment has a hypothetical expected growth rate of 2% a year, represented by the dotted line. The actual growth of the value of the investment could turn out to be quite different. The expected growth rate is merely a forecast of the average annual growth the investment could achieve in the future based on an assessment of information available at the time.

The other lines on the chart are a small sample of the many possible paths an investment could take in the future. The volatility is seen through the movement of the investment value up and down over the whole period. The changes in value can be greater or less than the expected growth rate or can even be negative.

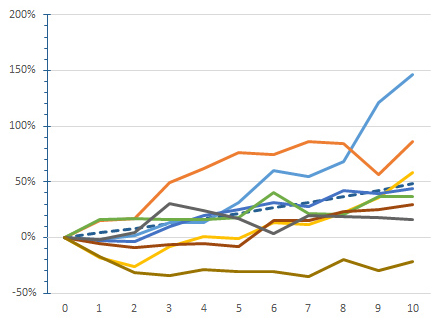

The chart below illustrates what happens when volatility is greater.

Selection of possible future paths of a more volatile investment

This investment has twice the volatility of the previous example. It also assumes the expected growth rate is twice as high to justify taking more risk.

The yearly up and down movements in each path can be greater. The distribution of overall changes at the end of the period is also wider. This shows there is greater uncertainty over what the value of the investment will be at the end of the period.

Conclusion

If you’re looking for higher growth rates, it’s likely you’ll need to accept greater volatility. Conversely, if you’re looking for less risk and lower volatility, you should expect a lower growth rate.

Higher volatility means greater ups and downs in value while you’re invested and a wider range of possible outcomes with the possibility of both greater losses and greater gains.

One way to reduce the impact of volatility risk is to make sure you’ve got cash holdings you can access in an emergency. This can reduce the possibility of being forced to sell your investments during a dip in value.

Many factors can affect the risk and expected returns of an investment, such as the characteristics of the investment itself, market conditions, liquidity, valuation, investor sentiment and how long you’re looking to invest for.

You should decide what would be an appropriate amount of risk to take, considering how much you can afford to lose, and the time you’re planning to invest for.

Next steps

If you’re not sure if you’ve got the right balance between risk and reward, think about getting in touch with a financial adviser. If you don't have one, visit MoneyHelper to understand the different kinds of advice available and how to find an adviser local to you. You'll usually have to pay for any advice you receive.

This article was last updated in November 2025

Featured articles