Investing with diversification

Investing in any asset involves some level of financial risk. Different assets come with lower, medium, or higher levels of risk. Understanding these risks is key to making informed decisions.

Common types of investment risk

Market risk: The chance that investments lose value due to changes in market conditions. For example, a stock market crash.

Inflation risk: The risk that inflation reduces the real value of your investment. For instance, if your savings earn 1% but inflation is 3%, your money loses purchasing power.

Interest rate risk: When interest rates change, the value or growth rate of certain investments—like bonds—can be affected. For example, bond prices often fall when interest rates rise.

Volatility risk: Investments can fluctuate in value. Volatility risk describes how much and how often these changes happen. Shares in smaller companies, for example, may rise or fall quickly, while cash or government bonds are usually more stable.

Liquidity risk: Sometimes, it may be difficult to sell an investment quickly at its fair market value, which can cause delays or losses when you need cash.

To help manage risk, fund managers use diversification. This means investing in a mix of different assets, each with different risk levels, all within the same fund. The fund’s asset mix directly affects its overall risk profile.

How does diversification work?

Put simply, it’s about not putting all your eggs in one basket. By investing in a variety of assets, you reduce the impact of any one investment performing poorly – other investments may be able to help offset any losses.

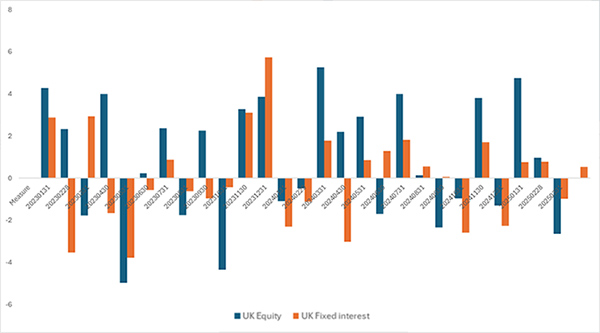

For example, the graph below shows how a Zurich UK equity fund and a Zurich UK fixed interest fund1 performed monthly from January 2023 to March 2025.

The UK equity fund (in blue) had greater volatility, showing bigger changes in value than the fixed income fund.

In some months, the funds moved in opposite directions, showing how different market forces affect their value.

Monthly performance of a Zurich UK equity fund and a Zurich UK fixed interest fund

Holding both investments together helps spread the risk.

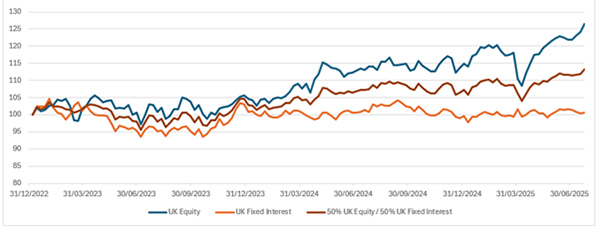

Another example (January 2022 to July 2025) compares actual performance of a Zurich UK equity fund and a Zurich UK fixed interest fund, plus a hypothetical 50/50 combination of both. By the end of the period, the equity fund had performed better than the fixed interest fund, with the combined portfolio’s performance sitting between the two.

Please remember: Past performance is not a reliable indicator of future results.

Performance of a Zurich UK equity fund, a Zurich UK fixed interest fund and a 50/50 blend of both

This example shows that while equities can be more volatile, combining them with fixed interest can create a steadier investment. The benefit of diversification here is achieving a higher return than fixed interest alone, without a proportionate increase in risk2. In other words, your “risk-adjusted return” can be higher.

Ways to diversify investments

Investing in a range of companies within UK equities, so the impact of losses from any single company is reduced.

Including equities from other regions such as the US, Europe, and Japan, to spread risk across different countries and markets. This would also likely have an additional benefit of investing in a larger number of companies.

Combining global equities with other assets like UK Gilts, corporate bonds, property, overseas government bonds, and cash—as is common in a Managed Fund.

Investing more in less volatile assets can help reduce short-term risk but may limit long-term growth. This means that while safer assets may be suitable for short-term goals, over longer periods, inflation can erode their value.

Asset allocations

Funds such as Zurich’s Managed Funds can hold different asset types. Each asset usually has a target allocation and a range, adding up to 100%. The fund manager can adjust holdings within these ranges to respond to market conditions, aiming to achieve the fund’s objectives while keeping the portfolio diversified.

The targets represent the fund’s Strategic Asset Allocation. Adjustments within the ranges are called Tactical Asset Allocation. Tactical changes don’t guarantee better results, but offer flexibility.

For example, a fund might target 26% UK equities, 18% US equities, and so on. Over time, the fund’s strategic allocation may change gradually as the outlook for different assets evolves.

Example strategic asset allocation of a managed fund

Footnotes:

1The Zurich UK equity fund refers to Zurich UK Opportunities 1 EP fund. The Zurich fixed interest fund refers to Zurich UK Fixed Interest 1 EP fund. The 50:50 combination is a hypothetical mix, rebalanced monthly. This is for illustration only. Past performance is not a reliable indication of future results.

2In other words, the return per unit of volatility—or “risk-adjusted return”—is higher.

This article was last updated in August 2025

Featured articles