Fund information: conventional plans

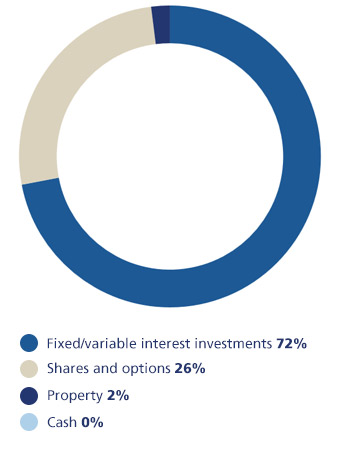

The with-profits 90:10 fund shares out its profits and losses at a ratio of 90% to policyholders and 10% to Zurich. The fund invests in fixed and variable interest investments, shares, property and cash.

Asset Mix

The mix of investments varies between groups of plans:

For pension plans (excluding Esitran*) the fund currently invests solely in fixed and variable interest investments, to match the high guarantees these plans provide.

The asset mix for life and Esitran plans is shown below:

Fund investment mix by value at December 2025

The investment mix has not changed significantly during 2025 and there are no current plans to significantly change the investment mix as we expect around 28% to remain invested in shares and property.

* ”Esitran” is the marketing name of a pension product (available from 1985 to 1996) specifically for the purpose of receiving the transfer of the benefits built up through membership of an occupational pension scheme.

How did the fund perform in 2025?

As the fund invests differently for different types of plans it provides different rates of return:

For pension plans other than Esitran, the return achieved in 2025 was 6.3% before tax and charges.

For Esitran plans, the return achieved in 2025 was 9.8% before tax and charges.

For life and investment plans, this return reduced to 8.0% before charges because of tax on investment returns.

The charges for managing the fund remain on average below 0.7%.

Previous performance figures

Life and Esitran plans

Before taxes and charges

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|

| 8.7% | 8.7% | 0.5% | 9.9% | 2.2% | 2.5% | -9.9% | 8.8% | 3.9% | 9.8% |

| After tax | |||||||||

| 7.2% | 8.3% | 0.6% | 8.1% | 1.9% | 2.2% | -7.7% | 7.2% | 3.3% | 8.0% |

Pension plans other than Esitran

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|

| 16.2% | 4.2% | 0.6% | 9.3% | 9.7% | -4.9% | -25.1% | 5.8% | -0.9% | 6.3% |

Current bonus rates

The rates below were declared on 12 January 2026.

Some plans include guaranteed returns that are higher than those the fund has achieved since your plan started and those we expect from the fund in the future. For these plans no regular or final bonus is currently being paid.

For plans where guaranteed returns are lower than those the fund has achieved since your plan started, bonuses are currently being paid.

See below for more details.

Regular bonus rates

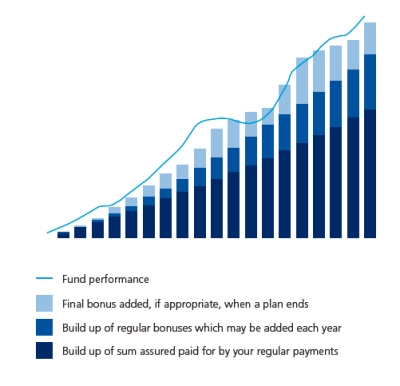

Regular bonuses are added to plans as a percentage of the basic sum assured and bonuses added to date (existing bonus).

| Product Type | Life Plans | Pension Plans |

|---|---|---|

| Product Type | ||

| Bonus on Sum Assured | 1% | 0% |

| Bonus on Existing Bonus | 1% | 0% |

Final bonus rates

Pension plans, other than Esitran plans, are not attracting any final bonus.

Final bonus rates are not guaranteed as they are periodically reviewed and changed from time to time (without notice) to ensure everyone receives their fair share of the fund's performance. The rates are based on fund performance over the time of the investment in comparison to bonuses already added. Any final bonus is calculated as a percentage of attaching bonuses only.

Where a plan has been increased, each increase is treated as a separate plan when considering the time of the investment to determine the final bonus rate. Although rates are generally lower for longer durations, they are applied to a much higher level of existing bonuses.

As the fund is closed, we aim to give all remaining investors a fair share of the estate (the part of the fund we use to help maintain bonus rates when returns are lower or to meet unexpected payments from the fund). For 2026, the final bonuses paid to investors leaving the fund will include an estate distribution of 95% of asset share, unless plan guarantees are higher. Note: This rate is not guaranteed and can change at any time which may cause significant changes in plan values.

This table below shows the current final bonus rates.

| Start Year | Final Bonus for plans maturing during 2025 |

|---|---|

| All years | 661% |

| Esitran | |

| 1984-1990 | 111% |

| 1991-present | The final bonus rate varies by year. |

How do I know you're managing the fund properly?

Zurich Assurance Ltd has to tell its with-profits policyholders each year if it has complied with its obligations in the PPFM (Principles and Practices of Financial Management). It does this through the annual report (last published in June 2025, next issue due June 2026) from the board of directors, including a separate report from the with-profits actuary on Zurich Assurance Ltd's compliance with the PPFM. In preparing the report, the directors seek the view of the independent person.

It is the opinion of the board of directors that during 2024:

- the company has complied with its obligations in the PPFM

- the way discretion was exercised was appropriate

- competing or conflicting rights, interests or expectations were addressed in a reasonable and proportionate manner.

The report contains further information on this, particularly for bonus rates, investment strategy, surrender values, expenses and charges, changes to the PPFM and customer communications. (You may wish to refer to the PPFM for the definition of technical terms).

The board of directors have appointed Alison Carr to provide it with an independent assessment of compliance with the PPFM. Mrs Carr will also advise the board on how any competing or conflicting rights and interests of policyholders and shareholders have been addressed. This role is a senior manager appointment (SMF15) within the FCA’s Senior Managers and Certification Regime. The board have given Mrs Carr this Statement of Responsibilities for her role. The Statement of Responsibilities covers all aspects of the management of and the exercise of discretion in respect of the fund, including those matters which Rule 20.5.3 of the FCA’s Conduct of Business Sourcebook requires to be covered in a terms of reference.

Information we send to customers

In March each year we send customers information about the fund performance. For life plans it includes details of the bonus added. A copy of the leaflet showing the latest fund performance can be found through the following links:

How is the with-profits 90:10 fund managed?

The Principles and Practices of Financial Management’ (PPFM) shows how we manage the money in the with-profits 90:10 fund. This was last updated in January 2026.