Frequently asked questions

Table of contents

Accessing the Zurich Access Portal

How do I register to use the Zurich Access Portal?

Go to www.zurich.co.uk/corporate-risk/zurich-access-portal which gives you full details of the portal and how to register.

Do I need an agency number?

Yes, if you are the first person from your firm to register and you don’t have a relationship with us already, you’ll need to apply for an agency number.

Do I have to sign a new Terms of Business Agreement for the portal?

Yes, if you are the first person from your firm to register and don’t have a relationship with us, you will need to complete a new Terms of Business Agreement. This will delay the completion of your registration.

I have registered but can’t download a quote or view existing policies.

If you’re the first person from your firm to register, we’ll need to run a few checks. These usually take up to 5 working days. Once they’re done, we’ll let you know if you’re all set or if we need anything else from you.

If your firm is already registered, your firm’s portal administrator will need to complete your registration. They’ll link you to the right agency code(s) and set up your access and sharing permissions.

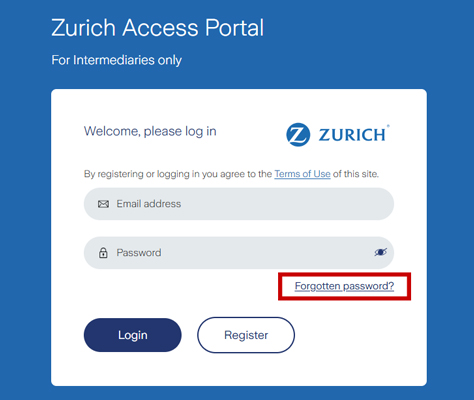

What if I forget my password?

Click on the forgotten password link on the login screen and enter your email address you registered with. You will then receive an email with instructions to reset your password.

What should I do if I have issues signing in?

If you keep seeing ‘invalid email address or password’ and you’re sure your details are correct, your account might be locked because of too many failed attempts.

If that’s the case, email us at zapsupport@uk.zurich.com. We’ll unlock your account so you can reset your password.

Quoting

What type of clients can I quote for?

If the customer (principal employer) and any participating employers are UK registered limited company with a Companies House registration number, you can obtain a quote.

You cannot quote if the customer is a limited liability partnership (LLP) or a branch of an overseas company.

The policy is already insured with Zurich; can I get a quote?

No, the policy must be new to Zurich.

However, we can help. If you already have a Zurich policy, we’ll look at converting it so it can be managed in the portal when the rate guarantee end date arrives.

What occupations are allowed in the portal?

Most. However, if the following duties/occupations are included within the membership you will need to email zcrquotes@uk.zurich.com to request a quote outside of the portal:

- Travel for work to destinations against Foreign, Commonwealth and Development Office advice

- Work offshore

- Nuclear power generation or services that support this industry

- Manufacture, process, or storage of explosives

- Manufacture of hazardous chemicals and/or toxic substances

- Underground mining, surface mining, quarrying or dam construction

- Military personnel or armed security personnel

- Police officers, fire fighters, coast guards or prison guards

- Pilots (fixed or rotary wing)

- Professional sportspersons

- Medical doctors, registered nurses, paramedics, or ambulance personnel

- Barristers

- Non-executive directors can’t be included in Group Income Protection or Group Critical Illness quotes

What size policies can I get a quote for?

You can quote for policies with 3 or more employees.

What is the maximum number of previous claims allowed?

Two claims within the last 5 years.

What are the absentee requirements?

You will be asked to supply details of any long-term absentees in order to get or apply for a quote. These will be referred to a scheme underwriter to review who will let you know how to proceed.

Is there a limit on the number of categories?

A maximum of 4 categories can be created for Registered, Registered Group Life Master Trust, Group Income Protection, and Group Critical Illness quotes.

Excepted and Excepted Group Life Trust Solution policies limited to one category in view of HMRC rules.

Can I get a quote with a mixture of registered and excepted benefits?

No. If you need a quote that includes multiple trusts, please send your request to zcrquotes@uk.zurich.com.

What methods of payment are available in the portal?

Premiums can be paid monthly by Direct Debit and or annually by Direct Debit or Direct Credit. The same rates will apply regardless of the premium frequency or method.

Is there a minimum premium?

Yes, the minimum annual premium is £450.

Can I get a flex quote in the portal?

No. If you need a quote for a scheme that includes flexible benefits including Spouse Partner Life Assurance (SPLA) please send your request to zcrquotes@uk.zurich.com.

What Group Income Protection benefits do you offer in the portal?

- Basic benefit from 40% to 80% of salary with any offset up to £10,000

- 8,13, 26, 41 & 52-week deferred periods

- Escalation rates of 0%, 2.5%, 3% & 5% with Retail Price Index (RPI) options

- Benefit payment terms to terminating age and 2, 3, 4 & 5-year limited payment options

- A lump sum (capital option) for quotes with a limited payment option

What Group Life benefits do you offer in the portal?

- Lump sum benefit of 0.5 to 15 times policy salary

- Fixed benefits up to £1,000,000

Can redundancy cover be included for Group Life schemes?

Yes, you can request up to 24 months redundancy cover. For request to include up to 12 months redundancy cover, there will be no change to the rate(s).

Can I get a Group Critical Illness quote via the Zurich Access Portal?

Yes, you can.

Can I get a quote where the scheme is closed to new employees?

Group Life Insurance and Group Income Protection quotes must have at least one category for new members to join.

Group Critical Illness quotes cannot have any closed categories.

What eligibility definitions are available?

Seven default eligibility definitions are available:

- All permanent employees which include fixed term contractors (FTCs)

- All pensionable employees

- All directors and managers

- All directors

- All managers

- All other employees not included in any other category

- All salaried partners

- Other - Free format. These will be checked when you apply for cover.

Can I include a service requirement to the eligibility?

Yes, there are four default options available; none, 3, 6 or 12 months, or a free format option to set another service requirements.

What definitions of salary are available?

Four default salary definitions are available and a free format option:

- Basic annual salary or wages, before any salary sacrifice

- Basic annual salary or wages, after any salary sacrifice

- Basic annual salary or wages only, plus the annual average of any other earnings from the employer over the preceding 3 years (or since joining that employer if this was within the preceding 3 years)

- P60 earnings in previous tax year or annualised averaged earnings for members who joined within the same tax year

- Other - Free format. These will be checked when you apply for cover.

What terminating ages can be covered?

Group Life Insurance quotes: You can select from 60 to 75, including State Pension age.

Group Income Protection quotes: You can select from 60 to 70, including dynamic State Pension age and State Pension age.

Can I quote if the scheme has medically loaded members?

Group Life Insurance quotes: All extra mortality/morbidity (EM) loadings can be included but will be referred to a scheme underwriter if greater than 250EM. You cannot include a per mille loading.

Group Income Protection quotes: All EM loadings can be included but will be referred to a scheme underwriter if greater than 100EM. You cannot include a per mille loading.

If a member of a scheme has a per mille loading applied, you will need to request a quote by emailing zcrquotes@uk.zurich.com.

Can I quote if the scheme includes members with a decline or postpone decision, had an exclusion applied or have been restricted due incomplete medical underwriting?

Where a member has been underwritten and has either been restricted, declined, postponed, or had an exclusion applied you will be able to request a quote through the Zurich Access Portal.

Any quotes requested with one of these decisions will need to be assessed by a scheme underwriter before the quote can be downloaded.

Do I need to use a data template?

Yes, you will need to use the data template which you can download on the quote journey.

Can I carry out requotes?

Yes, you can carry out requotes by selecting the requote option from the “What do you want to do?” drop down list.

How long is the quote guaranteed for?

Quotes are guaranteed for 90 days. However, you can refresh the quote and get a new variation if you need to discuss further with your client.

Can you provide a quote where there are zero-hour contractors or TUPE members?

TUPE members can be included where the membership is open to new members joining.

Zero-hour contractors can be included in a Group Life Insurance quote subject to scheme underwriting agreement.

What are the rules about overseas travel on a portal case?

Travel is allowed but not for those who are travelling for work to destinations against Foreign, Commonwealth and Development Office advice.

Does the portal cover employees who are resident or seconded overseas?

No, the portal doesn’t cover overseas members for new business cases.

What is the minimum automatic acceptance limit on the portal for a Group Life/Group Income Protection quote?

Group Life is £650,000.

Group Income Protection is £80,000.

Applying

Can we apply for cover online?

Yes, you can apply online for a portal quote.

Here’s what we’ll need from you: the names, positions, and business email addresses of all authorised signatories.

Once we’ve done our usual business checks, we’ll send proposal forms and direct debit mandates to the authorised signatories via DocuSign.

These need to be completed and sent back to us within 30 days.

Why have I received a DocuSign request after my client has signed the forms?

Although you will be able to download a copy of the complete form from the portal, we know you may not visit it every day, therefore DocuSign sends you a copy of the completed form.

What happens if the DocuSign forms are not completed within the 30 days?

After receiving our reminders, if any forms are not returned with 30 days, the policy will be cancelled from commencement. If the policy is still needed, you will have to obtain a new quote and reapply.

Where will I be able to access the policy documents?

These will be available to download in the existing policies area on the portal once the policy is in force.

When will documents be available to view and download?

After placing a policy

- The statement of account will normally be available shortly after you have received the on-risk email.

- Invoices will normally be available shortly after you have received the on-risk email.

- Policy schedules and proposal forms will be available shortly after you have received the completed proposal form from DocuSign.

- Direct Debit notification letters are normally available to view within 5 working days of the mandate being received.

After submitting a revision or rate review

- The statement of account, invoices for balance premiums and new Direct Debit notification letters will normally be available shortly after you receive the email confirming the revision or rate review has been successful.

- Updated policy schedules will normally be available shortly after you receive the email confirming the rate review has been successful.

Who do I contact if I have a query or need help?

- Portal registration email zapsupport@uk.zurich.com

- Quote/apply email zcrquotes@uk.zurich.com

- Medical underwriting email medical.underwriting@uk.zurich.com

- Group Life claims email zcr.life.claims@uk.zurich.com

- Group Income Protection claims email zcr_claims@uk.zurich.com

- Or you can speak to your usual Zurich contact

Why can’t I see my scheme in the portal?

It maybe because the scheme isn’t in force yet, the scheme has been cancelled, or your registration hasn’t been linked to the correct agency code. For retention records please refer to our privacy policy.

Servicing

I need to make changes to the policy, what do I do?

For changes to the benefit design please email zcrquotes@uk.zurich.com.

For general servicing changes please email zcrservicing@uk.zurich.com.

Or you can speak to your usual Zurich contact.

Can I complete a revision or rate review on the portal?

Yes, this is an important function of the portal.

When is the annual revision/rate review invitation issued?

We’ll send you an invitation 90 days before your policy’s revision date or rate guarantee expiry date. It’ll go to the contact person you’ve given us.

You can submit revisions or rate reviews as early as 21 days before the yearly revision date. If you need a rate review quote earlier, you can get one through the portal.

We’ll keep reminding you about any revisions or rate reviews that are still outstanding. If they’re not completed within 60 days of the yearly revision date or rate guarantee end date, we’ll start contacting the policyholder directly.

If they’re still not done 90 days after the yearly revision date or rate guarantee end date, we may have to cancel the policy.

What is the earliest date I can fully complete the revision/rate review?

21 days before the policy’s yearly revision date.

Can I get an indicative rate review quote?

Yes, you will be given clear instructions of how to get the indicative quote 90 days in advance of the rate guarantee expiry date.

Do I need to send updated data in throughout the year?

You only need to give us information once a year. We’ll email you closer to the time to let you know what we need.

For full details, check section 9: "Information we need at the yearly revision date" in the terms and conditions.

If a member joins the scheme or their benefit goes over the automatic acceptance limit, please let us know as soon as possible with their full details, including an email address. This will allow us to start our underwriting process and temporary cover at the right time.

For more details, see sections 2.6 "Underwriting" and 2.7 "Temporary cover" in the terms and conditions.

What is the tolerance on the portal at revision stage?

For a unit rate policy, unless stated otherwise in your policy schedule, there’s a 25% tolerance until the rate guarantee end date.

For an individual costing policy, there’s no limit on tolerance until the rate guarantee end date.

For full details, check section 8.5 "Will premiums change at any other time?" in the terms and conditions.

Can I change the commission on a rate review quote?

Yes, you can change the commission on the quote.

Can I change the payment frequency on a rate review quote?

Yes, you can change this on the quote.

Can I request scheme history?

Yes, you can request this through the "Existing policies" area on the portal. When you find the policy you are looking for, select “Request scheme history” from the drop-down option.

You can also request a scheme history for a non-portal policy through the portal.

Is it possible to submit a claim for my customer in the portal?

Yes, you can do this in the "Existing policies" area on the portal. When you find the policy you are looking for, select “Submit a claim” from the drop-down option.

You can also notify us of a claim for a non-portal policy through the portal.

Can I request a policy termination?

Yes, you can request this through the "Existing policies" area on the portal. When you find the policy you are looking for, select “Initiate policy termination” from the drop-down option.

You can also request a termination for a non-portal policy through the portal.

Can I update the regular customer contact?

Yes, you can do this during the revision or rate review process. Outside of this, send your request to zcrservicing@uk.zurich.com.

I want to change who in my firm is the administration contact, what do I do?

You can do this within the "Existing policies" area on the portal. When you find the policy you are looking for, select “Update policy admin contact” from the drop-down option.