Insolvency trends and implications for directors

12/16/2025

In January 2023, we published an article (here) exploring the significant increase in company insolvencies following the Covid-19 pandemic and highlighting the potential exposures faced by directors of companies facing insolvency. In this follow-up article, we revisit the subject of insolvencies around three years on, to examine recent UK trends and explore how directors' duties have evolved in the intervening period. Zurich’s management liability package policy, Executive Risk Solutions, provides bespoke insurance cover for exposures specific to insolvency scenarios, as well as providing general cover for Directors & Officers (D&O) and corporate liability exposures.

Trends in Company Insolvencies

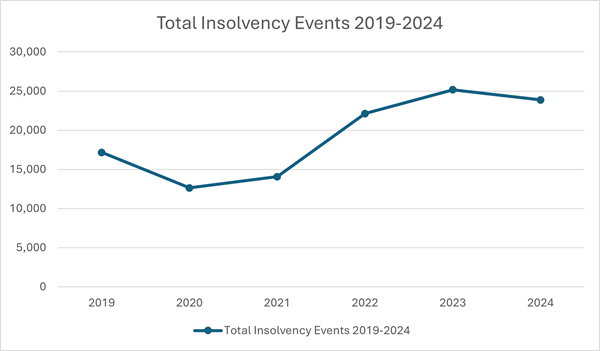

During the pandemic years of 2020 and 2021, when many businesses benefitted from support packages and economic stimuli provided by the UK government, the rate of insolvency events fell significantly on previous years. However, following the end of the pandemic and the return to 'business as usual,' insolvencies increased dramatically on pre-pandemic levels. Data from the Insolvency Service and Companies House shows a c. 57% increase in insolvency events between 2021 and 2022. This was likely the result of unviable businesses that were supported through the pandemic failing to survive once that support was withdrawn.

This trend of increasing insolvencies continued into 2023, a year which saw 25,163 insolvencies. By comparison, in 2019 (the last full year before the pandemic) 17,170 insolvency events took place. At the end of 2024, insolvency events were up c. 39% on 2019. The most recent figures for 2025 indicate that it is likely to see a similar level of insolvencies, suggesting a long-term shift in the annual rates of insolvency events, rather than simply a post-pandemic peak.

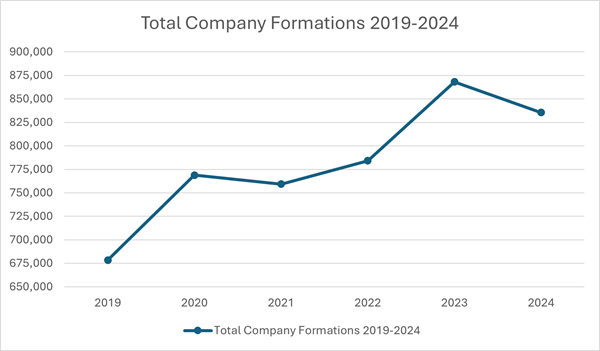

Data from Companies House indicates that one key factor driving higher overall numbers of insolvency events is an increase in the number of new companies being incorporated since the pandemic. The 2020/21 financial year, which was most greatly affected by the COVID-19 lockdowns, saw a c. 22% increase in company formations on the previous financial year. The annual number of company formations has continued to sit broadly at pandemic levels, with the effect that there were c. 20% more registered companies at the end of 2024 than there were at the same point in 2019. As more companies are formed, it follows that more companies will fail and enter into insolvency.

Nevertheless, the scale of the increase in insolvency events over the past five years cannot be entirely attributed to the rise in company formations. It is likely that challenging economic circumstances across this period have affected companies' abilities to survive. These include high interest rates affecting the cost of borrowing, an increase in corporation tax rates and an increase to employers' national insurance contributions. There have also been industry-specific storms to weather. For instance, construction companies accounted for c. 17% of insolvency events in 2024, a year in which the construction giant ISG collapsed owing extensive trade debts.

With so many companies experiencing insolvency events – and so many more being formed every day – it is essential that directors understand the liability risks to which they can be exposed.

Duties Owed to Creditors

Once a director realises that the company will enter insolvent liquidation, they become subject to a duty to act in the best interests of the creditors of the company. The existence of such a duty was confirmed by the UK Supreme Court in BTI 2014 LLC v Sequana SA [2022] UKSC 25 and it is referenced by section 172(3) of the Companies Act 2006. The BTI case indicated that this duty takes the form of a "sliding scale", meaning that the interests of the creditors should acquire more weight as the company's financial difficulties worsen. The Court suggested that where the company is insolvent or "bordering on" insolvency, the directors should consider the interests of creditors, balancing them against the interests of shareholders where they may conflict.

This is likely to be a challenging line for many directors to identify but it is important that they try to do so. Directors who fail to comply with this duty can be exposed to personal liability to administrators, liquidators and/or creditors. Earlier this year, the directors of a company that defended a winding-up petition brought by its creditors until the day of trial, despite having no prospect of success, were subject to a costs order in favour of the creditors (Cresta Estates v MPB Developments Limited [2025] EWHC 198 (Ch)). The directors had argued that it was in the company’s interests for them to contest the winding-up in the hope of reaching settlement. The Court disagreed, ruling that they had failed to take into account the creditors' interests as required by the BTI case and so were personally liable for the costs.

As the case law continues to develop, it may be that the point at which the directors must consider the interests of the creditors becomes easier to judge. However, it is clear that this assessment will always be a balancing act of potentially competing interests. This balance is made particularly difficult by the general duty of the directors to act in the best interests of the company. The door is therefore open to shareholders to take action against over-cautious directors who place too much weight too soon on the creditors' interests at the expense of failing to promote the success of the company, as much as it is open to creditors to take action against directors who fail to weigh their interests when required.

Potential Penalties and Liabilities for Directors

In addition to the liability arising from breaching the duty to creditors, UK legislation subjects the directors of an insolvent company to a number of potential penalties, should they be found to have acted irresponsibly. Some key examples are discussed below.

Claims for Wrongful Trading

Wrongful trading claims can be brought under section 214 of the Insolvency Act 1986. This is a civil claim, under which a director can be compelled by the court to make a personal contribution to the pool of assets available to the company's creditors. It applies where a director knows that the company will enter into insolvent liquidation, decides to continue trading, and cannot show that their actions were done entirely to minimise the loss to creditors.

Prosecutions for Fraudulent Trading

Fraudulent Trading is a criminal offence under section 213 of the Insolvency Act 1986. It applies where a director has acted with the intention of defrauding creditors or for a fraudulent purpose. The maximum sentence if convicted is ten years' imprisonment. The court also has the power to impose a liability for a contribution against anyone knowingly involved in the fraud.

Actions for Disqualification

Under section 6 of the Company Directors Disqualification Act 1986, a director of an insolvent company can be disqualified for up to 15 years where the court is satisfied that their conduct makes them "unfit" to be a director.

Post-pandemic, there has been a significant increase in the average length of director disqualifications, driven in part by actions against directors who fraudulently claimed government support packages during the pandemic. The average length of a director disqualification in the 2019/20 financial year was 5.3 years, compared with 8.3 years in 2024/25. This demonstrates an increasing willingness from the court system to punish those directors who do not take their responsibilities seriously.

Current Liability Market

As we have seen, the level of insolvencies in the five years since the pandemic indicates a long-term increase in the annual rates of insolvency events, rather than simply a post-pandemic peak. In these circumstances, it is vital for directors to ensure they have suitable D&O cover in place to protect them from exposure to insolvency related liabilities.

The litigation funder market has significantly grown in recent years, which has resulted in insolvency practitioners of insolvent SMEs assigning claims against former D&Os to funders with deeper pockets to pursue litigation. This further illustrates the importance of D&Os having sufficient cover in place to help defend such claims.

Zurich’s Executive Risk Solutions policy is designed to support and protect directors, officers and senior employees during these challenging scenarios. It provides comprehensive cover for investigation and defence costs as well as preparation costs ahead of attending insolvency hearings. In addition, we offer flexible extended reporting periods in the event of a change of control, acquisition, or the appointment of receivers, liquidators, or administrators to the insured company.