How indemnity periods could help in the fight against underinsurance

06/23/2024

According to the Chartered Institute of Loss Adjusters (CILA) 43% of business interruption insurance is underinsured by 53% on average.

We at Zurich have many articles on the subject of underinsurance but what we want to concentrate on here is a specific issue, is your Business Interruption indemnity period long enough?

The adequacy of indemnity periods needs to keep pace with this changing landscape and the repercussions of lengthy interruption periods has been brought in to sharp focus due to a recent high court judgement.

What is Business Interruption?

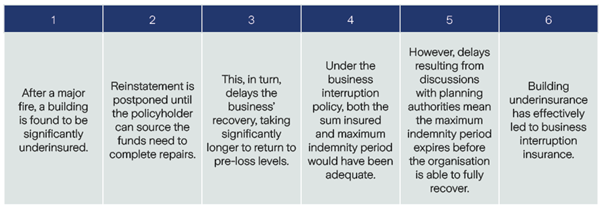

Business interruption (BI) insurance provides a lifeline following a loss, supporting organisations financially until they make a full recovery. However, inaccurate sums insured and inadequate indemnity periods are jeopardising the chances of recovery for many businesses.

The importance of having the right indemnity period

Setting the right indemnity period is crucial for businesses. An indemnity period is the length of time that benefits are payable under an insurance policy following a loss. When the period runs out, the claims payments will stop.

In the current economic climate, it can take months or even years for a customer to get back into the position they were in prior to the loss. Whilst it might then be an obvious thought to make the indemnity period as long as possible, we understand that projecting the income of a business, taking account of future trends and allowing for influences like inflation is complex.

"What is often underestimated is the length of recovery period", says Louise Butcher of Mclarens. "A business does not bounce back to pre-loss performance levels on day one, yet that is when the indemnity period clock starts ticking. For example, the business may be seasonal with a large proportion of their turnover within a 6 month period therefore the timing of a loss may be critical. Or in the case of a listed building where it could take up 6 months to design repairs and secure scaffolding, planning, access and environmental considerations on site or machinery in place".

Keeping in mind the delays that we have outlined above alongside new considerations such as the impact of lead times for carbon friendly machinery and materials we would strongly recommend any risk with a 12 or 24 month indemnity period reassess whether this will give adequate protection taking into account delays in the supply chain, backlogs in planning departments, legislative challenges, customer loyalty and any other matters likely to influence the time taken to resume operations at the same level as pre-loss.

The role of brokers and insurers

For brokers, they are there to support their client and it is so important that customers seek the guidance of their insurance broker to understand all the demands and needs of their business and ensure suitable cover is in place.

For insurers, we can support with insight gained from dealing with customer claims, highlighting the effect of the extended delays that we see can occur due to supply chain issues.

Given the devastating impact underinsurance can have, brokers and insurers need to work together to reduce the impact of underinsurance to their clients and customers.